Finally, adhere to up with your tax authority and insurance company to make sure they know the adjustment. If you pay your real estate tax or home insurance with your mortgage, see to it whatever is upgraded so that no repayments are late or missed. A residence mortgage is a finance provided by a financial institution, home mortgage company or various other financial institution for the purchase of a key or investment house. Other, less common sorts of home loans, such as interest-only home mortgages as well as payment-option ARMs, can include complex repayment routines and are best utilized by advanced customers. With an adjustable-rate mortgage, the rates of interest is dealt with for an initial term, after which it can change occasionally Best Vacation Timeshare Companies based on prevailing interest rates. The initial rate of interest is usually a below-market price, which can make the home loan more affordable in the short term yet possibly much less affordable long-term if the price climbs considerably.

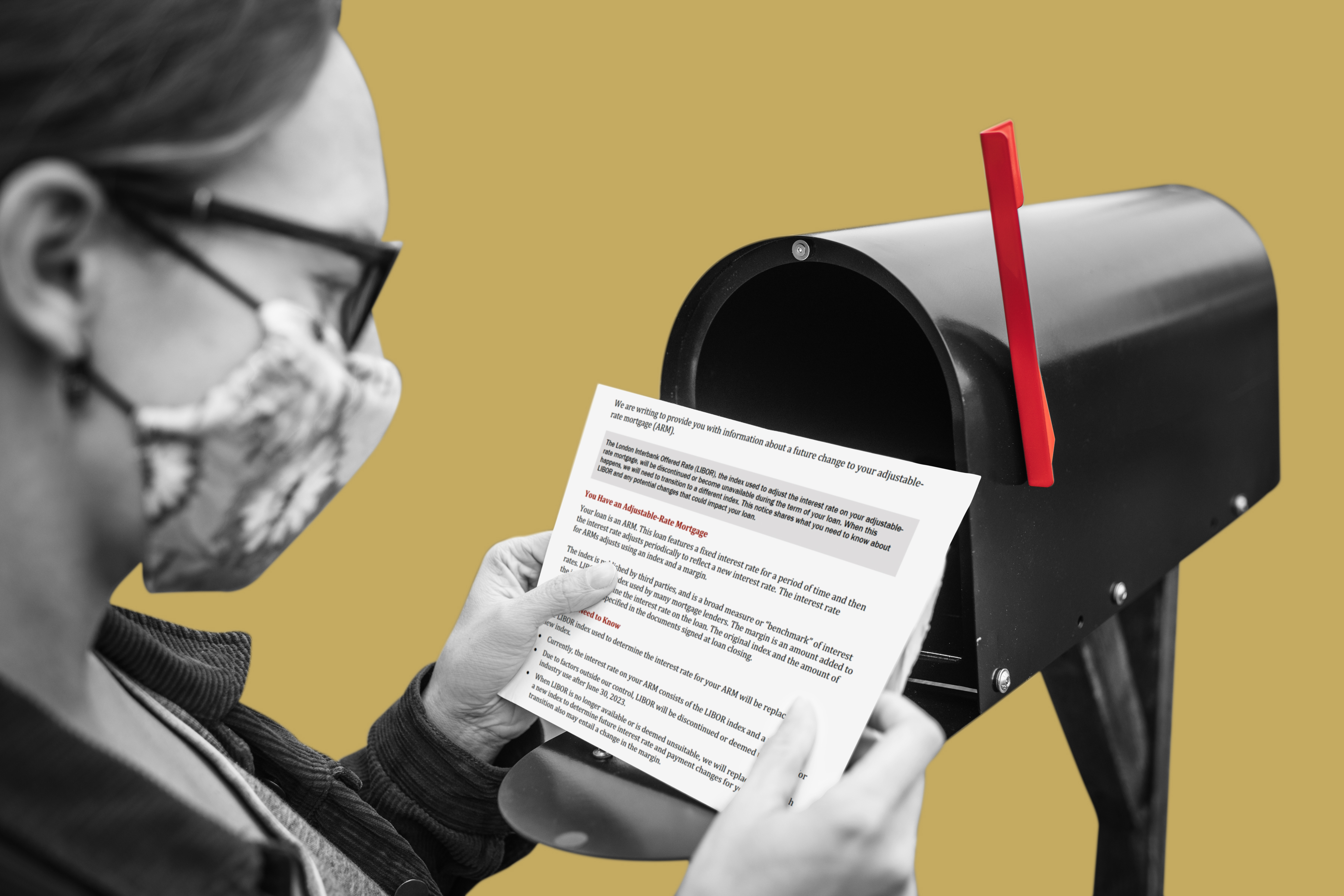

If you've obtained a letter stating your home mortgage has actually been sold, you're not alone. And also while it can absolutely be worrisome to recognize your funding has actually changed hands without your say-so, it's not a peril. Andy Smith is a Licensed Financial Coordinator, licensed real estate agent as well as Timeshare Vs Vacation Club teacher with over 35 years of diverse monetary administration experience.

- The federal government, however, does not assure Freddie Mac as well as Fannie Mae.

- Lower-income consumers would feel one of the most effect because adapting loans would certainly end up being quicker available as well as rates of interest would drop.

- The purchaser or assignee assembles these fundings into collections, or "pools".

- Diverse liquidity premiums for related tools and also changing liquidity over time make this a difficult task.

For instance, some loan providers will certainly allow an one-time adjustment if mortgage prices need to fall after you secure your price. However it's an additional thing to take into consideration when you're taking a look at different lending institutions. One instance of this is the brand-new lending programs licensed by Fannie Mae and also Freddie Mac that need only 3 percent down on 30-year finances for customers with great debt. So if you have an interest in a marginal deposit without going the FHA course, your normal bank might not use this specific car loan kind. Since it enables loan providers to slice up their home loans, the secondary market also enables economic firms to focus on various locations of the marketplace. For example, a financial institution might come from a financing however market it in the second market while preserving the right to service the home mortgage.

Car Loan

Practitioners typically make use of specialised Monte Carlo methods or changed Binomial Tree numerical options. Prime home loans are conforming mortgages with prime consumers, full documentation, solid credit scores, and so on. Low-quality mortgage-backed protections backed by subprime mortgages in the United States created a dilemma that played a major duty in the 2007-- 08 global financial dilemma. By 2012 the marketplace for top quality mortgage-backed safety and securities had actually recuperated and also was a revenue facility for US financial institutions. Ginnie Mae guaranteed the first mortgage pass-through safety and security of an authorized lending institution in 1968. In 1971, Freddie Mac released its initial mortgage pass-through, called a participation certification, made up primarily of exclusive mortgages.

The brand-new servicer can not require that you develop an escrow account," states Baker. For instance, mortgages can be cut into tranches with varying degrees of security-- as well as the more secure the bond, the reduced its return, usually. So, capitalists searching for a greater interest settlement can buy rather riskier mortgage-backed safeties, while those who need to purchase higher-rated bonds can purchase the much safer tranches.

Home Loan Aid And Also Assistance

Considering that shadow banks would certainly end up being a lot more leading, higher capital requirements would certainly additionally move home mortgage credit scores risk off financial institution balance sheets to the GSEs as well as indirectly to the united state There's a lot going on behind the scenes of the home mortgage market that customers might not understand. Due to the fact that it acquires a huge section of mortgage, the second market drives a great deal of the behavior in the key market, such as the banks' wish to create conforming car loans. While you may remain to make your monthly repayment to the financial institution that originated the lending, the cash may really be going to several capitalists that own your home loan or a piece of it. In the USA, one of the most usual securitization depends on are funded by Fannie Mae and Freddie Mac, US government-sponsored business. Ginnie Mae, a United States government-sponsored enterprise backed by the full confidence and credit report of the United States government, guarantees that its financiers receive timely repayments yet gets restricted numbers of mortgage notes.

Prepaid passion or home mortgage discount factors are a method to get down Cancel Your Timeshare your rate of interest. Determining whether it makes sense to acquire factors entails doing a little bit of math. While some financial institutions still do this today, the development of the MBS has actually altered points up a bit. However, if the cost of loaning funds is too reduced, this also has a tendency to imply that the cash you have saved in the past deserves less than if greater borrowing costs made funds scarcer. If your money isn't worth as a lot, costs can rise rapidly, as you need to part with even more money to get the very same worth.

Given that you are receiving repayments of both interest as well as principal, you don't get handed a lump-sum principal repayment when your MBS grows. This section looks at the monetary side of house acquiring-- whether you're a new customer or otherwise-- consisting of the different mortgage kinds, added prices you require to factor in and also help you may be able to obtain. The market is experiencing a higher shift from internal servicing to outsourcing, moved by higher regulatory scrutiny and also the obstacle of default servicing.